Legal Literacy - This article discusses in depth about fiduciary as a form of guarantee on movable objects according to Law Number 42 of 1999, covering the basis law, object and subject of the guarantee, registration, execution, and the implications of the Constitutional Court Decision Number 18/PUU-XVII/2019 in business practices, as well as solutions to overcome obstacles that arise in the execution of fiduciary guarantees.

Introduction

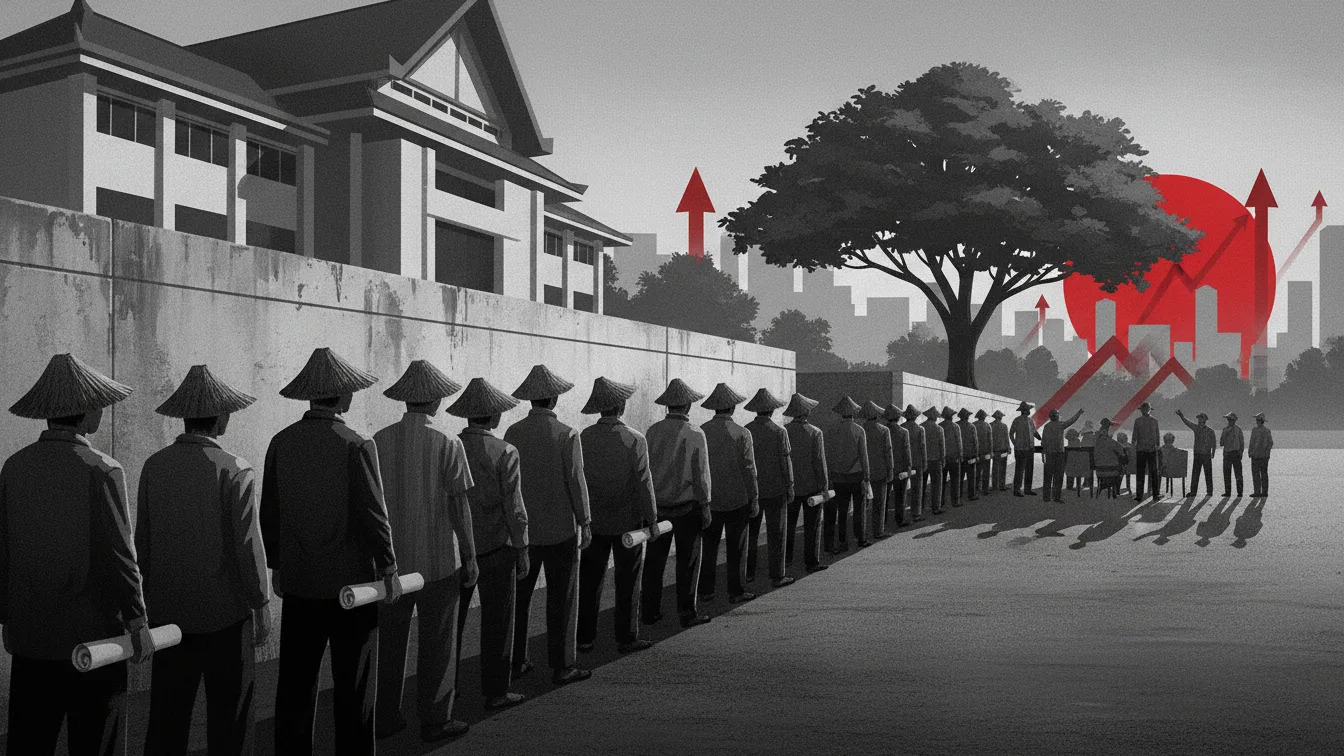

Fiduciary is one form of guarantee recognized in Article 1 paragraph (2) Law Number 42 of 1999 concerning Fiduciary Guarantees, where fiduciary is used as a guarantee right over movable objects. Fiduciary is one of the most commonly used forms of guarantee in financial transactions, especially in sales and purchase agreements. In a fiduciary agreement, the debtor hands over movable property to the creditor as collateral so that the creditor can ensure repayment of the credit if the debtor cannot repay the credit. The existence of a fiduciary guarantee can be guaranteed and can be used as collateral for credit repayment.

Fiduciary has several characteristics, namely: 1) Fiduciary is a guarantee right granted by the debtor to the creditor; and 2) Fiduciary can only be granted for movable objects. In Dutch terminology, the term fiduciary is often referred to in full as Fiduciare Eigendom Overdracht (FEO), which has the meaning of transferring ownership rights in trust, while in English, it is called Fiduciary Transfer of Ownership. In Law Number 42 of 1999 concerning Fiduciary Guarantees, there are parties involved in fiduciary, namely the fiduciary giver and the fiduciary recipient. The fiduciary giver is the party who gives the fiduciary, while the fiduciary recipient is the party who receives the fiduciary. Fiduciary can provide benefits for both lenders and borrowers.

According to Law Number 42 of 1999 concerning fiduciary, fiduciary is the right of ownership of an object based on trust with the provision that the object whose ownership rights are transferred remains under the control of the owner of the object. In a fiduciary agreement, the object used as collateral is goods that become the credit agreement. In the event of default, such as the debtor's inability to pay credit installments or repay the credit, or the transfer of the collateral object under the table, the fiduciary agreement provides protection to the lender to obtain the payments they should receive. The fiduciary agreement also gives the lender the power of executorial rights to revoke the fiduciary object without going through a court agreement if the debtor violates the agreement.

In business practice, fiduciary agreements are also used to protect the interests of creditors and ensure the repayment of debts between debtors and creditors. The fiduciary agreement is made at a notary with clauses that include the term of the agreement, the amount of credit to be paid, the method of payment, and the sanctions that apply if one of the parties violates it. If someone fails to repay a loan, there are several consequences that are received. Through this article, the author discusses in depth what fiduciary is and how its mechanism works in business practice.

Comments (0)

Write a comment