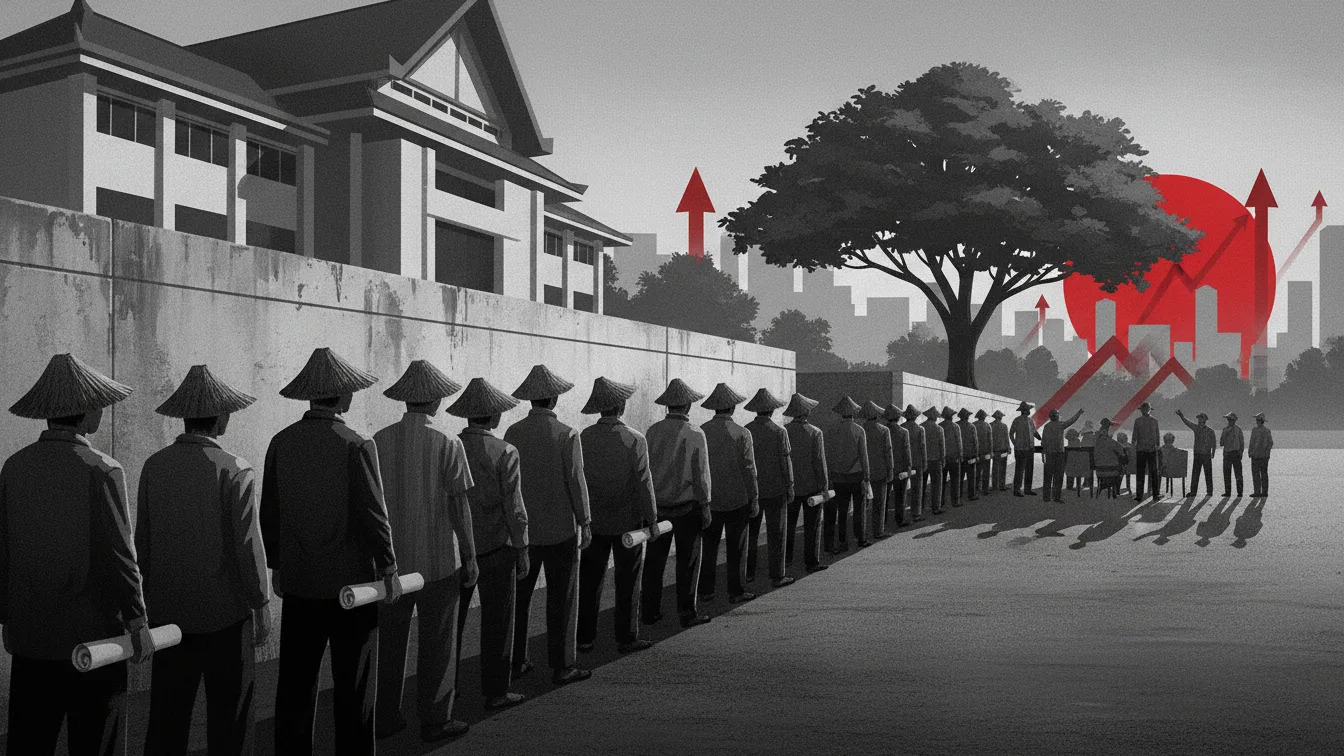

Legal Literacy - This article discusses the vital role of notaries in civil law, focusing on the creation and legal force of notarial cover notes in court. It explains the authority of notaries in making authentic deeds, the role of cover notes in credit transactions, and the legal implications arising from the issuance of cover notes. Reinforced by jurisprudence and related regulations, this article provides an in-depth analysis of how cover notes are valued as evidence in court even though they are not authentic deeds.

Introduction

Notaries have a very important role in the field of civil law. Notaries are positioned as public officials who have the authority in terms of forming authentic deeds regarding all actions, agreements and stipulations determined by law.

An authentic deed is a deed whose creation and regulation have been determined based on the Law on Notary Positions and Article 1868 of the Civil Code.

Legal Basis and Authority of Notaries in Making Deeds

A Notary is a state official who is able to provide assurance of certainty, order, and legal protection necessary regarding circumstances, events, or legal actions. According to Article 15 paragraph (1) of the Notary Position Law (UUJN) No. 2 of 2014, a notary is authorized to make authentic deeds regarding all actions, agreements, and requirements mandated by laws and regulations and/or desired by the interested parties to be stated in an authentic deed. The notary also guarantees the certainty of the date of the deed's creation, stores the deed, provides grosse, copies, and excerpts of the deed.

In addition, notaries also have other authorities regulated in laws and regulations, namely: (1) Taking actions related to land affairs, (2) Creating auction minutes deeds, (3) Creating copies of original private letters, and (4) Validating the conformity of copy letters with the original letters, and (5) Providing legal counseling in connection with the making of deeds.

The process of making a deed by a notary includes: (1) Consultation, (2) Document Preparation, (3) Deed Creation, (4) Deed Ratification, and (5) Storage and Provision of Copies.

Notaries have an important role in the process of buying and selling houses or other transactions. They act as experts who examine and verify documents related to the transaction. Notaries are also responsible for ensuring that the transaction is carried out in accordance with applicable law. Notaries are also responsible for reading and explaining the contents of the deed to all parties involved in the transaction.

The notary ensures that all parties understand and agree to the contents of the deed before signing it. The notary also ratifies the deed after all parties have signed it. A notary is required for most legal transactions. Notaries have an important role in ensuring the validity and legality of the transaction. Notaries act as public officials who make authentic deeds regarding legal actions, agreements, and stipulations required by laws and regulations. Notaries are also responsible for storing the deed, providing copies or excerpts of the deed, and providing assurance of the certainty of the date of the deed's creation.

Legal Consequences of Making Cover Notes by Notaries

In practice, a cover note made by a notary/PPAT is trusted by the bank as the basis for disbursing funds in a credit agreement. In practice, a cover note is trusted by the bank as the basis for disbursing funds in a credit agreement. A notary cover note is a document issued by a notary as proof that a document made by the notary has been signed and approved by the notary. A cover note is usually used as supporting evidence in the process of registering rights to land or property in court.

The use of a notary's cover note in a credit agreement provides convenience for creditors to disburse credit to debtors, especially in the case of encumbrance of mortgage rights that are still being processed by the notary/PPAT and a copy of the deed of security binding has not been submitted.

The emergence of the cover note is the result of an agreement between the bank and the Notary, where the Notary is willing to carry out what is requested by the bank in carrying out or making a legal act such as making a credit agreement deed, making a deed of granting mortgage rights or binding a certificate of ownership.

- The existence of a notary's cover note can have several consequences, both for the creditor, debtor, and the notary himself. For the Creditor, among others:

Legal uncertainty, this is because there is no guarantee that the mortgage rights promised in the cover note will be realized. - Financial loss, this is because if the mortgage rights are not realized, the creditor may experience financial loss, for example if the debtor defaults on the loan and the collateral object cannot be executed. The creditor can also lose his rights to the collateral object.

- Legal dispute, this is because there is a dispute regarding the rights to the collateral object.

For the Debtor, among others:

- Bound by a promise, this is because the Debtor is bound by the promise stated in the cover note, such as submitting the mortgage certificate to the creditor.

- Financial loss, this is because if the debtor cannot fulfill his promise in the cover note, the debtor may experience financial loss, such as being fined by the creditor.

- Legal dispute, this is because the Debtor can also be involved in a legal dispute with the creditor or a third party related to the rights to the collateral object.

For the Notary, among others:

- Violation of the code of ethics, this is because the issuance of a cover note by a notary can be considered a violation of the notary's code of ethics, because the cover note is not an authentic deed and does not have the same legal force.

- Disciplinary sanctions, this is because if a Notary is proven to have violated the code of ethics, disciplinary sanctions can be imposed by the Notary Supervisory Council, such as reprimands, warnings, suspension of office, or dismissal.

- Lawsuits, this is because the Notary can be sued civilly or criminally by parties who are harmed as a result of the publication of the cover note.

The Legal Force of Notarial Cover Notes as Evidence in Court

The cover note issued by the Notary/PPAT is not an authentic deed, but only a certificate issued by the Notary/PPAT office. This cover note functions as a temporary guarantee for the bank to disburse credit while waiting for the related deeds to be processed by the Notary

A notary cover note is a statement issued by a notary public that explains the process of creating an authentic deed or a specific legal action. A cover note does not have the same legal force as an authentic deed, but it can serve as additional evidence and is entirely dependent on the judge's assessment in court cases. This is in line with the Supreme Court Jurisprudence Number 1108/K/Pdt/2003, which states that “a cover note is not valid for use as the basis for the implementation of the rights and obligations of the parties in the agreement because a cover note cannot replace a notarial deed.”

References

- Article 1868 of the Civil Code

- Supreme Court Jurisprudence Number 1108/K/Pdt/2003

- Law on Notary Position (UUJN) No. 2 of 2014

Comment (0)

Write a comment