Legal Literacy - The Public Housing Savings (Tapera) program is a solution for middle to lower income communities to own decent homes through a routine savings scheme. Based on Government Regulation Number 21 of 2024, this program involves the government, financial institutions, and housing developers to provide affordable homes. Find out more about the participant criteria, mechanisms, and benefits of the Tapera program in this article.

Introduction

Owning a decent home is one of the basic human needs that must be met. However, many Indonesian people are still unable to realize this dream due to financial limitations. To help middle to lower income communities own decent homes, the Indonesian government has initiated the Public Housing Savings (Tapera) program. Public Housing Savings (Tapera) is a housing savings program that aims to help low-income communities obtain decent housing.

Public Housing Savings (Tapera) is a savings program carried out by participants periodically within a certain period of time which can only be used for housing financing and/or returned along with the results of its cultivation after membership ends. Basic of law regarding Public Housing Savings (Tapera) has been regulated in Government Regulation (PP) Number 21 of 2024 concerning Amendments to PP Number 25 of 2020 concerning the Implementation of Public Housing Savings. Public Housing Savings (Tapera) is a mandatory means of membership for all workers, both in the formal and informal sectors, with income below a certain limit. Through the Public Housing Savings (Tapera) program, each participant is required to save part of their income every month into a Public Housing Savings (Tapera) account.

Public Housing Savings (Tapera) is a special savings scheme for people who want to own a home. This program is implemented through cooperation between the government, financial institutions, and housing developers. Through this program, people can save regularly with affordable amounts, and after reaching a certain savings target, they are entitled to a house at a more affordable price. Through this program, people can save regularly with affordable amounts, and after reaching a certain savings target, they are entitled to a house at a more affordable price.

Government Regulation Number 21 of 2024 regulates various aspects related to Public Housing Savings (Tapera), including: participant criteria, savings mechanisms, the role of financial institutions, obligations of housing developers, as well as incentives and facilities provided by the government. This regulation also stipulates the provisions that must be adhered to by all parties involved in the Public Housing Savings (Tapera) program, such as: administrative requirements, house quality standards, and supervision of program implementation. With the enactment of Government Regulation Number 21 of 2024, it is hoped that the Public Housing Savings (Tapera) program can run effectively and provide optimal benefits for low-income communities in realizing their dream of home ownership. In addition, this regulation is also expected to encourage the growth of the housing sector and improve the welfare of society as a whole.

Criteria for Participants of Public Housing Savings (Tapera)

Based on Government Regulation Number 21 of 2024 concerning Amendments to PP Number 25 of 2020 concerning the Implementation of Public Housing Savings, the criteria for participants who can participate in the Public Housing Savings (Tapera) program are as follows:

- Indonesian Citizen (WNI);

- Earning an income not exceeding the income limit set by the government, which is a maximum of IDR 88,000,000 per month;

- Not yet owning a house or land to build a house;

- Being at least 21 years old or married;

- Having a minimum membership period of 12 months;

- Belonging to the low-income community group;

- Having permanent employment or a permanent business with regular income;

- Not having any credit or other loan obligations that may interfere with the ability to save;

- Willing to open a Public Housing Savings (Tapera) savings account at a designated bank or financial institution; and

- Willing to save regularly in accordance with the provisions stipulated in the Public Housing Savings (Tapera) program.

Participants who meet these criteria can register with the office managing Public Housing Savings (Tapera) or a designated bank/financial institution by completing the necessary administrative requirements. Once registered, participants will be given a savings book and are required to save regularly according to the set target. These criteria are designed to ensure that the Public Housing Savings (Tapera) program is genuinely intended for communities in low-lying areas who do not yet own a home. With these criteria, the government hopes that the Public Housing Savings (Tapera) program can help increase home ownership for middle to lower-class communities.

Mechanism of Public Housing Savings (Tapera)

The mechanism of Public Housing Savings (Tapera) is as follows:

- Opening a Public Housing Savings (Tapera) Account. Participants are required to open a special savings account at a bank or financial institution designated by the government;

- Savings Deposit. Participants are required to save regularly with a minimum amount of IDR 100,000 per month. Savings deposits can be made in cash, by transfer, or by salary/income deduction. Savings can be accumulated until the set savings target is reached;

- Savings Target. The savings target is set based on a certain percentage of the price of the house to be purchased. The percentage of the savings target is determined by the government, for example, 20% of the house price;

- Down Payment. After reaching the savings target, participants can use their savings as a down payment to buy a house. The remaining house payment can be paid off with a credit or loan scheme from a bank/financial institution;

- House Selection. Participants can choose a house built by a housing developer registered in the Public Housing Savings (Tapera) program. The house purchased must meet the quality standards and specifications set by the government;

- Savings Disbursement. Participant savings can be disbursed after the house purchase process is complete and all requirements are met. Savings disbursement is carried out by the bank/financial institution receiving the savings; and

- Home Ownership. After paying off the house, participants will receive a home ownership certificate in their own name.

Role of Financial Institutions of Public Housing Savings (Tapera)

Financial institutions have an important role in the implementation of the Public Housing Savings (Tapera) program, including:

- Account Management. Financial institutions are responsible for opening special Public Housing Savings (Tapera) savings accounts for program participants. This account is used to store and manage participant savings funds;

- Acceptance of Savings Deposits. Financial institutions are responsible for accepting savings deposits from participants on a regular basis, whether through cash deposits, transfers, or salary/income deductions;

- Management of Public Housing Savings (Tapera) Funds. Financial institutions are required to manage Public Housing Savings (Tapera) funds safely and develop them through safe and profitable investments for participants;

- Provision of Credit/Loans. Financial institutions can provide credit or loans to participants to pay off the remaining house payments after using savings as a down payment;

- Savings Disbursement. Financial institutions are responsible for disbursing participant savings after the house purchase process is complete and all requirements are met;

- Reporting and Supervision. Financial Institutions are required to submit periodic reports to the government regarding the management of Public Housing Savings (Tapera) funds and conduct internal supervision to ensure the program is implemented in accordance with applicable regulations; and

- Coordination with Related Parties. Financial institutions must coordinate with the government, housing developers, and other related parties in the implementation of the Public Housing Savings (Tapera) program.

Financial institutions play a role as managers of Public Housing Savings (Tapera) funds and facilitate the house purchase process for program participants. The involvement of these financial institutions is very important to ensure the security and smooth implementation of the Public Housing Savings (Tapera) program.

Obligations of Housing Developers of Public Housing Savings (Tapera)

Housing developers involved in this program have the following obligations:

- Constructing houses in accordance with the quality standards and specifications set by the government in the regulations. These standards include aspects of safety, comfort, accessibility, and habitability;

- Providing houses at affordable prices for Public Housing Savings (Tapera) participants, in accordance with the price limits set by the government;

- Cooperating with appointed financial institutions in the Public Housing Savings (Tapera) program to facilitate the house purchase process by participants;

- Providing transparent and accurate information to Public Housing Savings (Tapera) participants regarding house specifications, prices, locations, and other matters related to house purchases. Reserving sufficient housing availability to meet the demand of Public Housing Savings (Tapera) participants;

- Carrying out the administration process and managing house ownership certificates in the name of Public Housing Savings (Tapera) participants after the purchase process is complete. Providing after-sales service and guarantees for houses sold to participants in accordance with applicable regulations;

- Reporting periodically to the government regarding the implementation of the Public Housing Savings (Tapera) program, including the number of houses that have been built and sold to participants; and

- Complying with all applicable provisions and regulations in the Public Housing Savings (Tapera) program.

Housing developers have an important role in providing quality houses at affordable prices for Public Housing Savings (Tapera) participants. These obligations aim to protect the interests of participants and ensure the effective and purposeful implementation of the Public Housing Savings (Tapera) program.

Incentives and Facilities provided by the government for Public Housing Savings (Tapera)

The government provides several incentives and facilities to support the implementation of the Public Housing Savings (Tapera) program, including:

1) Tax Incentives

Income Tax (PPh) exemption on interest from savings received by participants. Reduction of Value Added Tax (VAT) for house purchases through the Public Housing Savings (Tapera) program.

2) Interest Subsidy for Loans/Credits

The government provides interest subsidies for loans/credits taken by participants of the Public Housing Savings (Tapera) program to pay off the remaining house payments.

3) Housing Finance Assistance

The government may provide housing finance assistance to participants of the Public Housing Savings (Tapera) program who meet certain criteria, such as down payment or housing installment assistance.

4) Licensing Facilitation Facilities

The government provides convenience in managing permits and administration related to housing development for housing developers involved in the Public Housing Savings (Tapera) program.

5) Land Provision

The government may provide state land for use in housing development for participants of the Public Housing Savings (Tapera) program.

6) Technical Assistance and Mentoring

The government provides technical assistance and mentoring to participants, such as counseling, training, and consultation related to the Public Housing Savings (Tapera) program.

7) Promotion and Socialization

The government conducts widespread promotion and socialization to the public to increase participation and understanding of the Public Housing Savings (Tapera) program.

These incentives and facilities aim to encourage public participation in the Public Housing Savings (Tapera) program, as well as increase affordability and purchasing power of low-income communities in owning homes. The government hopes that with these incentives and facilities, the Public Housing Savings (Tapera) program can run effectively and provide optimal benefits for the community.

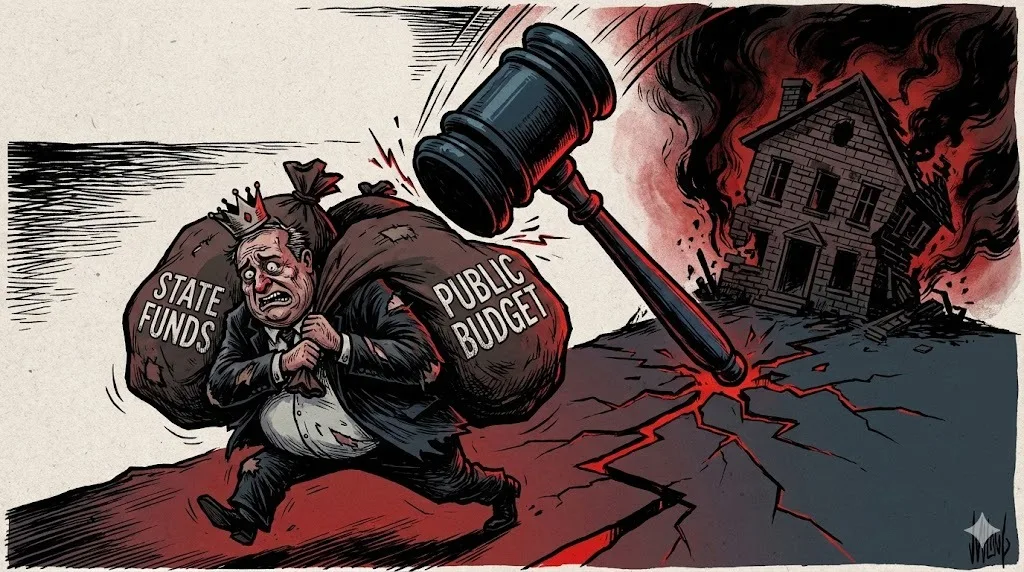

Controversy of Public Housing Savings (Tapera) in the Community

There has been considerable public controversy regarding the Public Housing Savings (Tapera) program since the enactment of Government Regulation Number 21 of 2024 concerning Tapera. Some of the controversies that have arisen include:

- Objections to the Mandatory Tapera Provisions. Many parties disagree with the mandatory nature of the Tapera program, especially for workers with low incomes. They assume this program will place a financial burden on the community.

- Concerns about Fund Management. The public underestimates the potential for protection or management of Tapera Funds that are not transparent by financial institutions or other related parties.

- Quality of Houses Built. Concerns have arisen that houses built under the Tapera scheme will be of low quality or not meet the promised standards.

- Access to Housing Locations. Some parties are concerned about the possibility of Tapera housing locations being far from city centers or areas with limited access to public facilities and transportation;

- Public's Ability to Save. There are doubts as to whether low-income communities are able to consistently save in accordance with the targets set in the Tapera program;

- Coordination among Stakeholders. There are concerns regarding the agreement on coordination between the government, financial institutions, and housing developers in the implementation of the Tapera program; and

- Impact on the Private Housing Sector. Some private housing developers suggest that the Tapera program will disrupt their housing market.

These polemics indicate that there are pros and cons from the public regarding the Tapera program. The government needs to carry out more effective socialization and communication to address public concerns and ensure the implementation of a fair, transparent, and beneficial program for the community.

Conclusion

Tapera is a special savings program that aims to help low-income communities to own decent homes with a periodic savings scheme. The criteria for Tapera participants include being an Indonesian citizen, having a maximum income of IDR 8 million/month, not yet owning a house, being at least 21 years old/married, and willing to save regularly. The Tapera mechanism includes opening an account, making regular savings deposits of at least IDR 100,000/month, reaching the savings target, paying a down payment, choosing a house, disbursing savings, and owning a house. Financial institutions play a role in managing accounts, receiving deposits, managing funds, providing credit/loans, disbursing savings, and coordinating with related parties.

Housing developers are obliged to build houses according to standards, at affordable prices, transparently, sufficiently to meet demand, and to manage ownership certificates. The government provides incentives such as financing/tax reductions, credit interest subsidies, financing assistance, ease of licensing, land provision, as well as assistance and outreach. There are pros and cons in the community regarding the mandatory nature, fund management, house quality, location, savings resources, coordination between stakeholders, and impact on the private sector. Overall, Government Regulation No. 21 of 2024 aims to facilitate decent home ownership for low-income communities through an affordable savings scheme involving financial institutions, developers, and incentive support from the government.

Comments (0)

Write a comment