Legal Literacy - This article discusses the legal consequences of State-Owned Enterprises (SOEs) not being registered in the list of bankrupt companies' receivables by implementing existing laws and regulations. Despite the updates in Law Number 37 of 2004 concerning Bankruptcy and Suspension of Debt Payment Obligations in reality, it is not sufficient to regulate protection in bankruptcy thus creating loopholes that can be exploited by irresponsible parties to pursue unilateral profits.

This article also explains the requirements for bankruptcy and the position of creditors in bankruptcy. Furthermore, it also describes the position of State-Owned Enterprises (BUMN) and the legal consequences of not being registered in the list of bankrupt company receivables.

What is Bankruptcy?

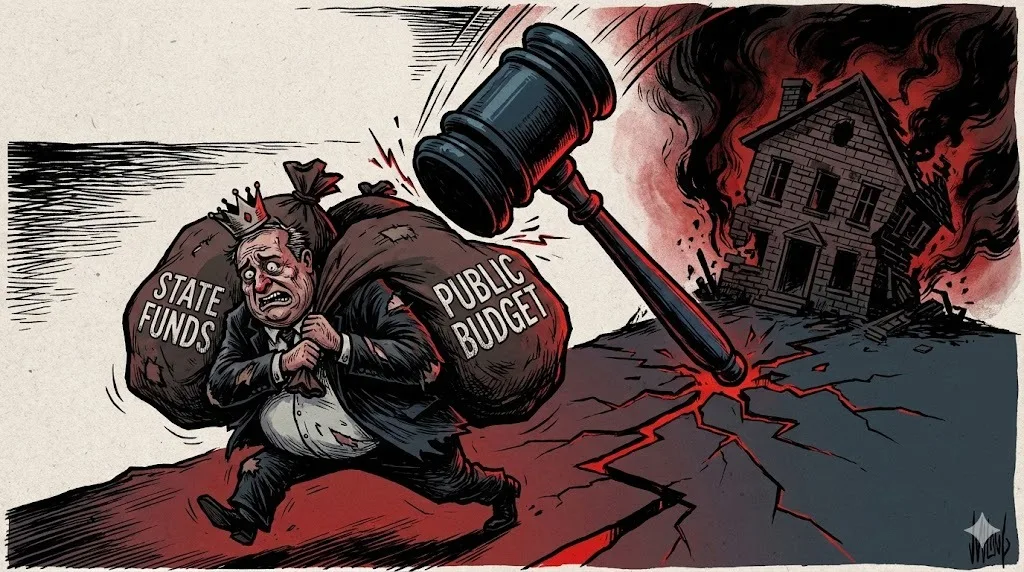

Bankruptcy is a general confiscation of all the assets of the bankrupt debtor, the management and settlement of which is carried out by a curator under the supervision of a supervisory judge as regulated in Law Number 37 of 2004 concerning Bankruptcy and Suspension of Debt Payment Obligations. In bankruptcy, there is a stage of registering receivables as material for consideration in a debt reconciliation meeting. However, currently bankruptcy has become a loophole for debtors to release responsibility for self-gain by not cooperatively coordinating with the curator regarding the identities of creditors. As a result, there are creditors who do not register their claims, which causes their right to receive bankrupt assets to be lost.

Bankruptcy Regulations and Bankruptcy Requirements

Bankruptcy is regulated in the enactment of Law Number 37 of 2004 concerning Bankruptcy and Suspension of Debt Payment Obligations as an update to Law Number 4 of 1998 concerning Bankruptcy. In the law, there are at least 3 conditions that must be met by the debtor, namely:

- The debtor has more than two creditors;

- The debtor does not pay at least one debt to one of the debtors when it is due and collectible;

- For bankruptcy filings, the debtor can apply himself or there is an application from one or more of his creditors.

The existence of bankruptcy requirements is clearly regulated in Law Number 37 of 2004 concerning Bankruptcy and Suspension of Debt Payment Obligations to avoid:

- Seizure of the debtor's assets as a result of collection by creditors carried out within the same period.

- Creditors who hold security rights in rem override the interests of the debtor and other creditors by selling the objects used as collateral.

- The possibility of the debtor having bad intentions by doing something related to the debtor's assets to then be given to one of the creditors with the aim of pursuing their own profits and harming other creditors.

Creditor's Position in Bankruptcy

Creditors in bankruptcy are classified into 3 different positions, including the first, Preferred Creditors, namely creditors who have special rights by law for their receivables to be prioritized over other creditors. As regulated in Article 1139 of the Civil Code regarding special privileges and Article 1149 of the Civil Code regarding general privileges. Second, Separatis Creditors are creditors who have security rights in rem belonging to the debtor for their receivables as regulated in Article 55 of the Bankruptcy Law and explicitly regulated in Article 1134 paragraph (2) of the Civil Code, and Concurrent Creditors are creditors who do not have security in rem and their receivables are not prioritized by law but still have the right to fulfill their receivables.

Position of State-Owned Enterprises

Contained in Article 1137 of the Civil Code regulates that claims for the rights of the state treasury, auction offices, and other legal entities formed by the government can be prioritized in their implementation, the duration of which concerns these matters. Article 1 Number 2 of Law Number 19 of 2003 concerning State-Owned Enterprises explains that a limited liability company or state-owned enterprise whose capital is at least 51% (fifty-one percent) of its shares is owned by the state with the aim of pursuing profits.

Even though BUMNs are not registered in the list of bankrupt company receivables, their status as state-owned enterprises fulfills Article 1137 of the Civil Code as receivables that can be prioritized by law. Without special guarantees, it does not eliminate the right of BUMNs to have their receivables prioritized by fulfilling the provisions of a public body formed by the government whose capital is at least 51% from the state. Therefore, the position of BUMNs on their receivables is a preferred creditor that has fulfilled the provisions of Article 1137 of the Civil Code.

Legal Consequences of State-Owned Enterprises Not Registered in the List of Bankrupt Company Receivables

After the bankruptcy ruling is pronounced by the judge, starting from 00.00 local time, the debtor loses the right to manage their assets. After the decision has permanent legal force, the bankruptcy decision can be executed, and then a general confiscation can be carried out as the initial step in settling the bankrupt's assets.

In this stage, the debtor loses the right to manage their assets. This can be both an advantage and a disadvantage for the creditor. For example, if a state-owned enterprise (BUMN) is unaware of the debtor company's bankruptcy and does not receive daily news regarding the deadline for submitting claims from the curator, it will impact the creditor's inability to register their receivables or even attend the receivables reconciliation meeting. The receivables reconciliation meeting or verification stage is the strongest guarantee to protect the rights of bankrupt creditors for the fulfillment of their receivables and has permanent legal force.

Even though a State-Owned Enterprise (BUMN) has the position of a preferred creditor, it is still not included in the list of receivables, consequently still unable to receive settlement assets from the bankrupt debtor company. Considering that the majority of BUMN capital comes from the state with the aim of pursuing profits, if its receivables are not registered in the list of receivables of the bankrupt company, it has the potential to cause state financial losses.

Comments (0)

Write a comment