Legal Literacy - If you as a creditor want to file a petition for bankruptcy against your debtor, the question that arises is whether it is necessary to send a demand letter first before filing for bankruptcy? The answer is yes, it is necessary. See the explanation in the following article.

Definition of a Demand Letter

A summons or reprimand is a warning from the creditor to the debtor to fulfill their obligations in accordance with the reprimand for the negligence that the creditor has conveyed to them. In it, the creditor expresses their desire that the agreement be implemented within a certain period.

Legal Basis

Although this term is not recognized in the Civil Code Civil Law (KUHPer), the legal basis for summons is regulated in Article 1238 of the Civil Code. This article states that the debtor is declared in default by a warrant, or by a similar deed, or based on the power of the agreement itself, namely if this agreement results in the debtor being deemed in default by the passing of the specified time.

The Importance of a Demand Letter Before Bankruptcy

In practice, even if an agreement has specified a deadline for the implementation of an achievement, the creditor will still send a letter of reprimand as a sign that the debtor has been warned and/or declared in default in writing.

A summons is necessary in the event that an agreement does not specify a deadline for the implementation of the achievement, because the declaration of a state of default is substitutive. In this case, a letter of reprimand is needed to make a demand to the authorities to fulfill their obligations immediately or within the time mentioned in the letter.

However, a summons does not only apply to the above case. If the agreement stipulates a specific time for the debtor to perform, this does not necessarily mean that by violating that time the debtor has committed a breach of contract. For this, a determination of default is still needed. In this case, a letter of reprimand is also needed as proof of the determination of default.

Types of Events That Do Not Require a Demand Letter

In the book "Principles of Contract Law" written by J.H. Nieuwenhuis, it is explained that there are five types of events that do not require a declaration of default, namely as follows:

1. Debtor Refuses Fulfillment.

The creditor is not required to give a warning if the debtor refuses to fulfill their obligations, because the summons will not change that attitude of refusal.

2. Debtor Acknowledges Their Negligence.

The debtor's acknowledgment of their negligence can be explicit or implicit, such as when the debtor offers compensation.

3. Fulfillment of the obligation is impossible.

The debtor is considered in default without the need for a summons, if the achievement that must be carried out is no longer possible, for example because the goods that must be handed over have been lost or destroyed.

4. Fulfillment No Longer Matters (Zinloos).

A notice of default (somasi) is not required if the debtor's obligation to provide or perform something can only be done within a certain time limit, which has passed, such as a wedding dress or a coffin that is delivered after the wedding or funeral is no longer meaningful.

5. Debtor Performs the Obligation Improperly.

In the event that the debtor does not properly fulfill their obligations, the creditor does not need to provide a notice of default (somasi) and can immediately declare the debtor in default (wanprestasi).

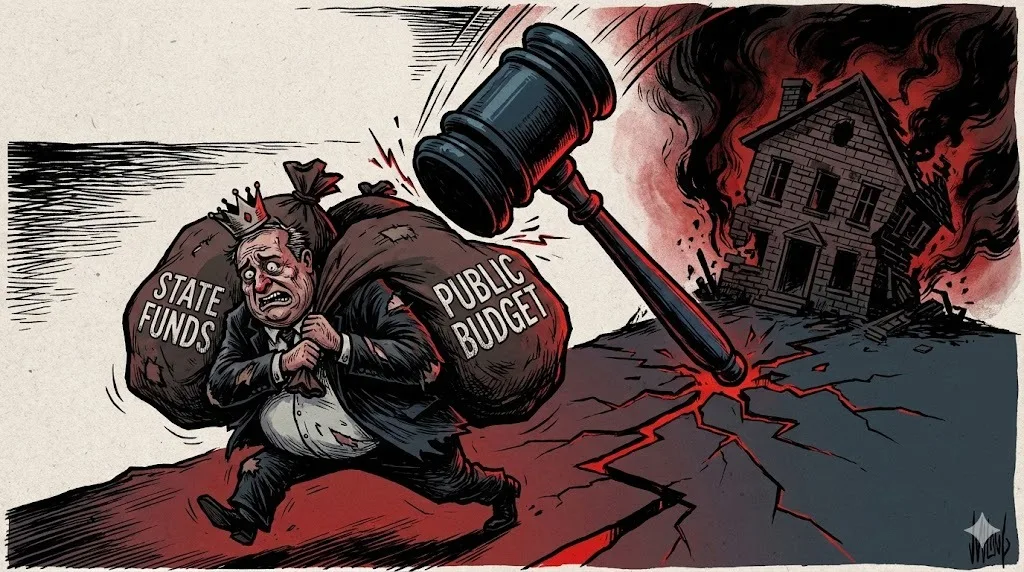

Conclusion

From the explanation above, it can be concluded that a notice of default (somasi) before filing for bankruptcy is very important because it can provide evidence of the determination of the debtor's negligence. A warning letter is also needed as a sign that the debtor has been warned and/or declared in default in writing. Therefore, before taking further legal action, the creditor is obliged to give the debtor an opportunity to settle the debt through the notice of default (somasi). The notice of default (somasi) usually includes the amount of debt, the payment deadline, and legal consequences that will be applied if the debtor does not pay the debt.

In some cases, a notice of default (somasi) can be an effective first step to resolving disputes between creditors and debtors without involving the courts. If the debtor responds by paying the debt in accordance with the terms in the notice of default (somasi), then the problem can be resolved quickly and without incurring large costs to obtain assistance from the court. However, if the debtor still does not pay the debt, then the creditor can take further legal action, such as filing a lawsuit in court or using the services of a professional debt collector to collect the debt from the debtor.

References

- Joko Sriwidodo and Kristiawanto. Understanding Contract Law. Yogyakarta: Penerbit Kepel Press, 2021;

- M. Khoidin. Liability in Civil Law. Yogyakarta: Laksbang Justitia, 2020;

- Setiawan. Principles of Contract Law. Bandung: Penerbit Binacipta, 2007

- Subekti. Principles of Civil Law. Jakarta: Penerbit PT. Intermasa, XXXI Edition, 2003;

- Wirjono Prodjodikoro. Collection of Scattered Legal Essays. Jakarta: PT Ichtiar Baru, 1974.

- Civil Code;

- Law Number 37 of 2004 concerning Bankruptcy and Suspension of Debt Payment Obligations as amended by Law Number 4 of 2023 concerning the Development and Strengthening of the Financial Sector.

Comments (0)

Write a comment