This article discusses the concept of bankruptcy in a practical way, starting from the definition and implementation.

The Concept of Bankruptcy: Definition

Bankruptcy is a legal process undertaken by a company or individual who is unable to pay their debts. In the bankruptcy process, the company or individual in question will be handed over to another party (namely a receiver) to settle all obligations and debts owed by the company or individual.

The Concept of Bankruptcy: Causes

1. Financial Problems

Financial problems are one of the main causes of bankruptcy. Companies or individuals who are unable to manage their finances properly and continuously spend more money than they earn may be unable to pay their debts.

2. Market Changes

Market changes, such as a decrease in market demand or the emergence of new competitors, can also be a cause of bankruptcy. Companies that cannot adapt to market changes or fail to anticipate competition from their competitors will experience a decrease in income and profits, resulting in an inability to pay their debts.

3. Management Errors

Management errors, such as incorrect policies or poor decision-making, can also lead to bankruptcy. Unplanned policies properly and poor decision-making can result in significant losses for the company, making it difficult to pay its debts.

4. Natural Disasters

Natural disasters such as floods, earthquakes and fires can cause major damage to company infrastructure and facilities, leading to a decrease in income and profits. As a result, the company may be unable to pay its debts.

The Concept of Bankruptcy: Impact

1. Job Losses

Company bankruptcy can lead to job losses for company employees. Employees will lose their source of income and find it difficult to find new jobs.

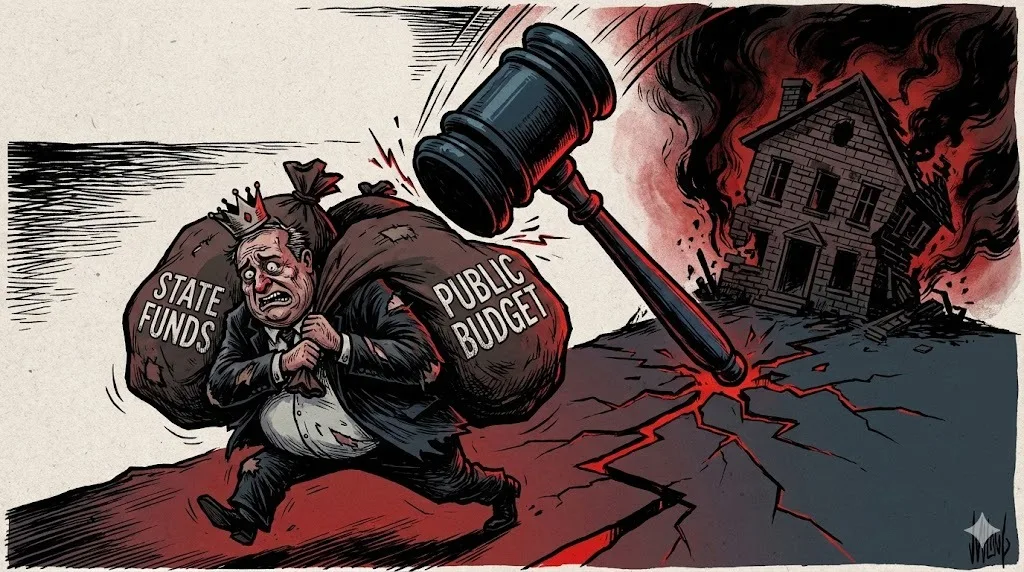

2. Losses for Creditors

Bankruptcy also has an impact on creditors who have provided loans to the company or individual in question. Creditors will not get back their entire loan and may have to bear financial losses.

3. Decline in Stock Value

Bankruptcy can also lead to a decrease in the value of shares for company shareholders. The share value will fall sharply and investors will experience financial losses.

4. Loss of Consumer Confidence

Bankruptcy can also lead to a loss of consumer confidence in the products or services offered by the company. Consumers will seek more stable and reliable alternatives, making it difficult for a bankrupt company to recover.

The Concept of Bankruptcy: Preventive Efforts

Managing Finances Well

Managing finances well is the most effective way to avoid bankruptcy. Companies or individuals must create a sound financial plan, avoid unnecessary expenses, and ensure that income always exceeds expenditure.

Adapting to Market Changes

Companies or individuals must always monitor market changes and adapt quickly. They must follow market trends and anticipate competition from their competitors.

Having Competent Management

Having competent management is an important factor in avoiding bankruptcy. Management must be able to make the right decisions and manage finances well.

Managing Risk Effectively

Managing risk well is another way to avoid bankruptcy. Companies or individuals must identify potential risks and develop strategies to mitigate their impact.

FAQs

What is bankruptcy?

Bankruptcy is a legal process undertaken by a company or individual who is unable to pay their debts.

What are the causes of bankruptcy?

The causes of bankruptcy can vary, including financial problems, market changes, management errors, and natural disasters.

What are the impacts of bankruptcy?

Bankruptcy can have significant negative impacts, including job losses, losses for creditors, declines in stock value, and loss of consumer confidence.

How to avoid bankruptcy?

Ways to avoid bankruptcy include managing finances well, adapting to market changes, having competent management, and managing risk well.

What to do in the event of bankruptcy?

In the event of bankruptcy, the company or individual must immediately report to the authorities, such as the court or relevant financial institution. They must also develop a plan to address the difficult financial situation and endeavor to pay their debts in a lawful and honest manner.

Comments (0)

Write a comment