Legal Literacy - This article discusses cases of arbitrary debt collection by debt collectors in Indonesia, OJK regulations governing cooperation with third parties, the importance of special power of attorney, and the legal implications of collection that does not comply with procedures.

Introduction

Although regulated by Financial Services Authority (OJK), cases of arbitrary debt collection by debt collectors are still widespread in our society. Financial Services Business Actors (PUJK), such as banks, financing companies, and online loans, often use the services of third parties to carry out debt collection. This article discusses the applicable regulations, the importance of special power of attorney, and the legal implications of collection that does not comply with procedures.

OJK Regulations on Collection Cooperation

In OJK Regulation (POJK) No. 22 of 2023 Article 61, it is stipulated that PUJK can cooperate with other parties for the collection of credit or financing to consumers. This collaboration must be stated in a written agreement with sufficient stamp duty and meet several important provisions:

- Legal Entity Form: The other party must be a legitimate legal entity.

- Permit from Competent Authority: The other party must have permission from the relevant authorized agency.

- Human Resources Certification: The other party must have human resources that have obtained certification in the field of collection from a professional certification body and/or organizing association registered with the OJK.

PUJKs are also required to be responsible for all impacts arising from the collaboration. Periodic evaluations of this collaboration are also required to ensure that the third party continues to meet the established standards.

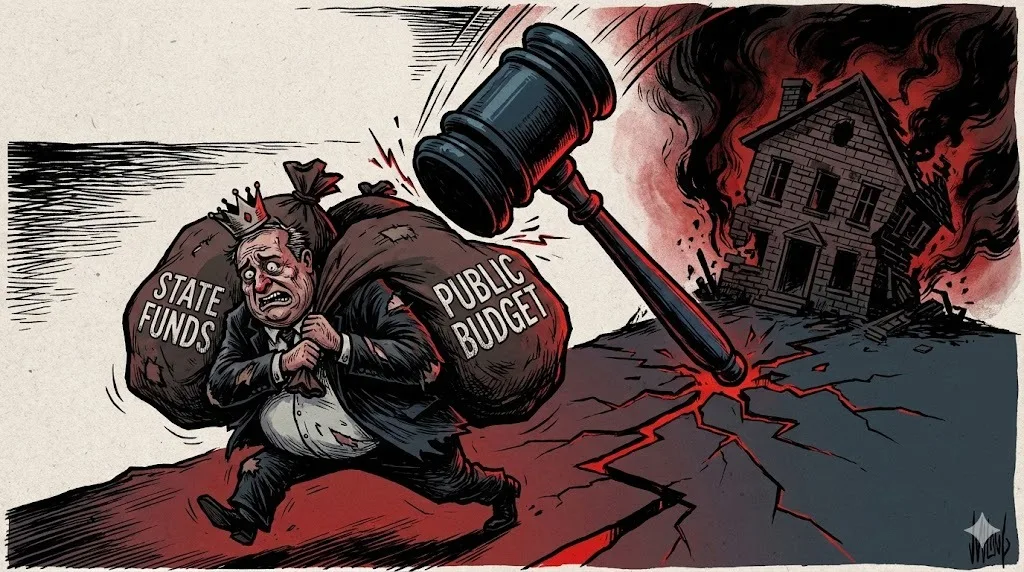

Sanctions for Violations

PUJKs that violate the provisions of Article 61 of POJK No. 22 of 2023 may be subject to various administrative sanctions, including:

- Written warning.

- Restriction of products and/or services.

- Freezing of products and/or services.

- Dismissal of management.

- Administrative fine.

- Revocation of product and/or service permits.

- Revocation of business license.

Administrative sanctions in the form of fines can reach IDR 15,000,000,000.00 (fifteen billion rupiah).

The Importance of Special Power of Attorney in Debt Collection

In practice, debt collectors often collect debts only based on an assignment letter from the PUJK. However, according to Article 1792 of the Civil Code, a special power of attorney is required to grant the attorney the authority to carry out certain actions on behalf of the principal. The special power of attorney explains the specific actions that the attorney is allowed to take.

In contrast, an assignment letter is merely an instruction from a superior to a subordinate to perform a specific task within an agency. An assignment letter does not have a strong legal basis like a special power of attorney. Therefore, a debt collector who only has an assignment letter does not have the legal standing to collect debts.

Differences Between Assignment Letters and Special Power of Attorney

- Special Power of Attorney: Regulated in Articles 1792 and 1795 of the Civil Code, granting authority to the attorney to take certain actions on behalf of the principal.

- Assignment Letter: Not specifically regulated in laws and regulations, usually used in internal relations of agencies or organizations to assign certain tasks.

Legal Implications of Collection Without Special Power of Attorney

A debt collector who collects debts without a special power of attorney is potentially committing an unlawful act, as stipulated in Article 1365 of the Indonesian Civil Code. This unlawful act occurs if:

- There is an action that violates the law.

- There is a fault committed by the perpetrator.

- There is a loss suffered by the victim.

- There is a causal relationship between the perpetrator's actions and the resulting loss.

If the debt collector continues to collect debts without a special power of attorney, the action can be considered an act of pidana extortion and threats, as stipulated in Article 368 of the Criminal Code. This article threatens the perpetrator with a maximum imprisonment of 9 months.

Conclusion

The use of debt collector services by Financial Service Providers (PUJK) must comply with strict rules, including a cooperation agreement and a special power of attorney. Violations of these provisions may not only result in severe administrative sanctions for PUJK, but may also cause serious legal problems for debt collectors. The public needs to better understand their rights in the face of collection actions that do not comply with procedures, to protect themselves from arbitrary and unlawful collection practices. With a better understanding of these regulations and legal implications, it is hoped that the public can be more proactive in reporting inappropriate collection actions and demand better protection from the authorities.

Comments (0)

Write a comment