Legal Literacy - The Social Security Organizing Agency for Employment (BPJS Ketenagakerjaan (Social Security for Employment)) is an institution responsible for organizing social security programs for workers or laborers. This article discusses the roles and challenges faced by BPJS Ketenagakerjaan in providing social protection for participants, as well as the importance of complying with established rules and obligations to ensure optimal benefits.

Understanding the Social Security Organizing Agency (BPJS)

The Social Security Organizing Agency for Employment (BPJS Ketenagakerjaan) is an institution established by the Indonesian government that is responsible for organizing social security programs for workers or laborers. BPJS Ketenagakerjaan was established based on Law Number 24 of 2011 concerning the Social Security Organizing Agency.

BPJS Ketenagakerjaan aims to provide social protection for workers or laborers, such as protection against the risks of work accidents, death, and permanent disability. In addition, BPJS Ketenagakerjaan also provides other benefits such as a pension program and guarantees old age.

BPJS Ketenagakerjaan has many policies and rules that must be adhered to by its participants. One important rule concerns BPJS Ketenagakerjaan contributions that must be paid by each participant on a regular basis. The amount of contributions to be paid will be determined based on the participant's salary. The following are some of the Benefits for Wage Recipients at the Social Security Organizing Agency for Employment:

Old Age Security (JHT)

The social security program aims to provide protection against the risk of losing income due to retirement, permanent disability, or death. Participants will receive cash as a benefit from the protection program.

Benefits in the form of cash, the amount of which is the accumulation of all contributions that have been paid plus the results of its development.

The complete benefits obtained include:

Cash paid in full if the participant:

1. reaches the age of 56 years;

2. resigns from work and is not actively working anywhere;

3. is terminated from employment, and is not actively working anywhere;

4. leaves the territory of Indonesia permanently;

5. suffers from permanent total disability, or

6. passes away.

a maximum of 10% for preparation for retirement or a maximum of 30% for home ownership if the participant has a membership period of at least 10 years, and can only be withdrawn a maximum of 1 time.

Work Accident Security (JKK)

The benefits provided when a Participant experiences a Work Accident or illness arising from the work environment are in the form of cash and/or health services.

Participants will receive benefits in the form of treatment and medical care as needed, compensation services in the form of money, and a Return to Work Program when experiencing conditions that require treatment due to an illness or accident.

Death Security (JKM)

Benefits in the form of cash are given to the participant's heirs if they die from causes other than work accidents or illnesses caused by the work environment.

The benefits provided include death benefits in the form of cash, periodic benefits, funeral expenses, and children's education scholarships.

Pension Security (JP)

The protection program is designed to ensure that participants maintain a decent standard of living when they experience a decrease in income due to reaching retirement age or experiencing permanent total disability.

The benefits received are cash that can be paid monthly on a periodic basis or in a single payment when the participant reaches retirement age, experiences permanent total disability, or passes away.

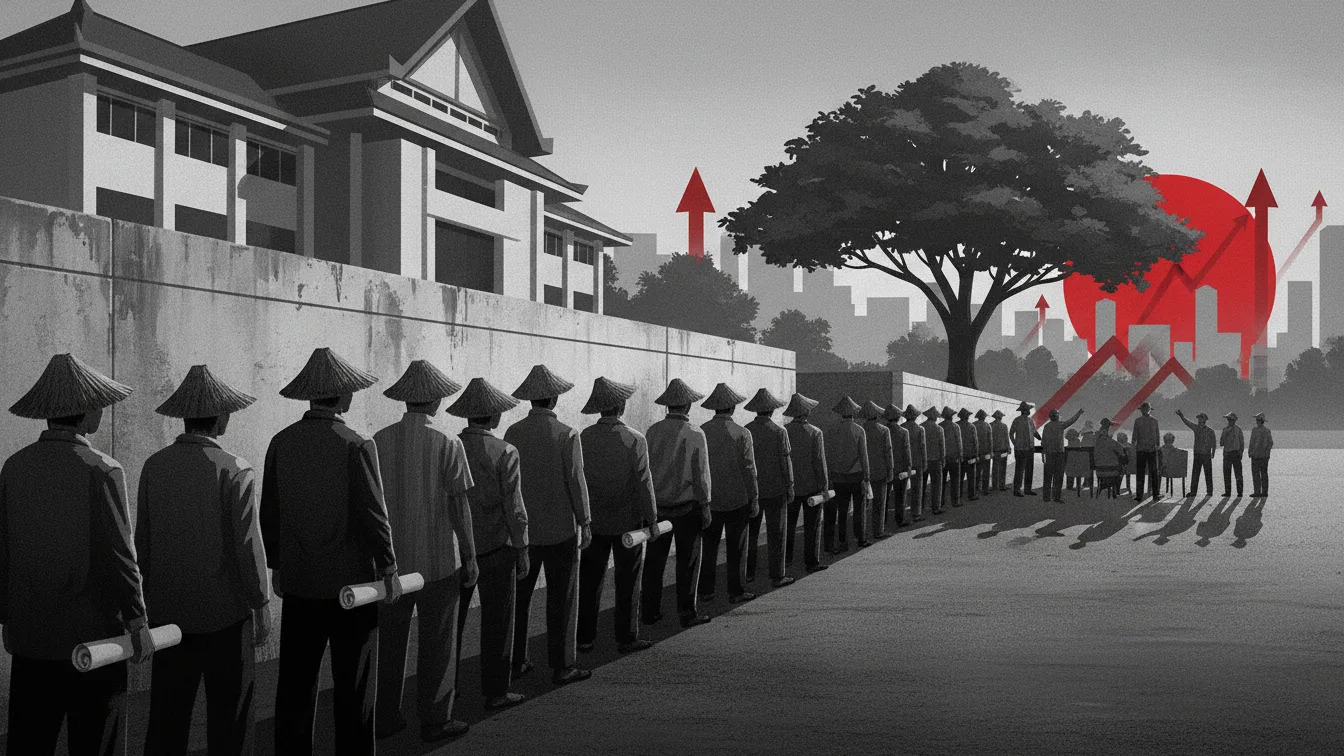

Job Loss Security (JKP)

Guarantees are given to workers or laborers who lose their jobs with the aim of ensuring that they continue to have a decent standard of living. With this guarantee, workers can meet basic living needs and try to find new jobs when there is a risk of termination of employment.

These benefits are provided to participants who have been laid off and are currently unemployed, but are committed to returning to the labor market. Participants may receive benefits if they have met the contribution period requirement of at least 12 months within 24 months of the JKP program and have continuously paid contributions for a minimum of 6 months. Visit the official BPJS Ketenagakerjaan website at www.bpjsketenagakerjaan.go.id.

How to Register for BPJS Ketenagakerjaan Online

- Please select the "Participant Registration" option and then select the "Wage Recipient" category.

- Fill in the available columns with your email address and captcha code, then press the "REGISTER" button.

- Please check your email

- and click the activation button to complete the registration process. Please complete the information on the monitor screen in accordance with your company data.

- After you receive the contribution code via email, please make a payment.

- The digital card will be sent to participants via email or can be picked up directly at the nearest Branch Office.

- Please fill out the membership registration form completely.

How to Register for BPJS Ketenagakerjaan at a Branch Office

- Please take a queue number first to register.

- Wait until your queue number is called.

- You will be notified of the amount of dues to be paid.

- You will be notified of the amount of dues payable.

- After that, you will receive a receipt of the registration document.

- Please proceed with the contribution payment.

- After the contribution payment is successful, you will receive a membership certificate and a Participant Card.

Comments (0)

Write a comment