This article discusses various modus operandi used by perpetrators of crimes in the field of taxation. This article will discuss the strategies used by perpetrators of tax crimes, as well as how to avoid and prevent such criminal acts.

Tax crime is a serious problem that affects the economic stability of a country. Indonesia, as a developing country with an increasingly advanced economy, faces a serious threat from tax crimes. The modus operandi used by criminals is increasingly evolving and difficult to detect, requiring the active role of all parties in preventing and combating criminal acts of taxation.

What is Tax Crime?

Tax crime is any act that violates the provisions of tax regulations that apply in Indonesia.This can be done by anyone, whether it's an individual or a business entity.

Perpetrator's Modus Operandi

The modus operandi used by perpetrators of criminal acts in the field of taxation is increasingly evolving and difficult to detect by law enforcement. Some of the modus operandi frequently used by perpetrators of tax crimes include:

1. Tax Evasion

The perpetrators of criminal acts commit tax evasion by not reporting all income received in tax returns. They also often use the services of accountants or tax consultants to conceal information that should be reported.

2. Tax Avoidance

The perpetrators of criminal acts commit tax avoidance by reducing the amount of income reported in tax returns. They use various methods, such as transferring profits abroad or manipulating financial statements.

3. Tax Document Forgery

The perpetrators of criminal acts falsify tax documents to avoid taxes that should be paid. They use fake documents, such as fake invoices or receipts, to cover up actual transactions.

Impact of Tax Crimes

Criminal acts in the field of taxation have a very serious impact on a country's economy and society. Some of the impacts include:

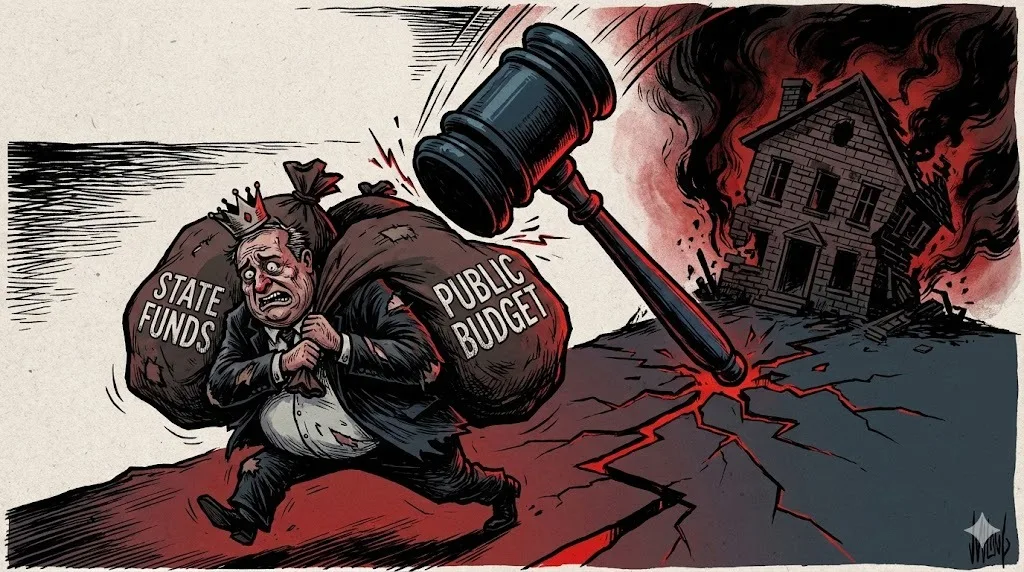

1. State Losses

Criminal acts in the field of taxation cause very large state losses. Every year, the state loses billions of rupiah due to tax evasion and avoidance.

2. Social Injustice

Criminal acts in the field of taxation also cause social injustice, because only a small portion of society pays taxes correctly, while most others avoid or evade taxes. This causes uneven development and reduces public trust in the taxation system.

3. Disruption of Economic Stability

Criminal acts in the field of taxation can also disrupt the economic stability of a country. When the state loses income from taxes, the budget for development and public services will be reduced. This can trigger economic instability, reduce investment, and reduce public welfare.

Government Efforts in Overcoming Tax Crimes

The Indonesian government has made various efforts to prevent and combat criminal acts in the field of taxation. Some of these efforts include:

1. Supervision and Law Enforcement

The government, through the Directorate General of Taxes, has carried out supervision and law enforcement against perpetrators of criminal acts taxation. Law enforcement officials have also conducted investigations into reported cases of tax crimes.

2. Socialization and Education

The government also conducts socialization and tax education to the public, especially in the business and industrial sectors. The aim is to increase public awareness about the importance of paying taxes and preventing tax crimes.

3. International Cooperation

The Indonesian government also establishes international cooperation in preventing and combating criminal acts in the field of taxation. This cooperation includes the exchange of information and supervision of taxation between countries.

Conclusion

Criminal acts in the field of taxation are a serious threat to the state and society. The modus operandi used by perpetrators is increasingly developing and difficult to detect, thus requiring the active role of all parties in to prevent and combat tax crimes. The government has made various efforts to prevent and combat criminal acts in the field of taxation, such as the implementation of supervision and law enforcement, socialization and tax education, and international cooperation.

FAQ

What are the modus operandi frequently used by tax crime perpetrators?

Answer: Several modus operandi frequently used by perpetrators of tax crimes include:

- Tax evasion: Perpetrators manipulate financial data to reduce the amount of tax payable.

- Tax avoidance: Perpetrators exploit loopholes in tax regulations to reduce the amount of tax that must be paid.

- Fictitious invoices: Perpetrators create fictitious invoices to obtain tax deductions that are not actually obtained.

- Mark up and mark down: Perpetrators manipulate selling prices or purchase prices in transactions to gain profits or avoid taxes.

- Document forgery: Perpetrators create false documents such as receipts, invoices, or other important letters to obtain tax deductions that are not actually obtained.

What are the legal consequences of tax crime?

- Fines: Perpetrators of tax crimes may be subject to fines of twice the amount of tax that was not reported or was misreported.

- Imprisonment: Perpetrators of tax crimes may be subject to imprisonment for five years.

- Tax recovery: Perpetrators of tax crimes must pay all taxes that should have been paid, along with fines and interest.

- Loss of reputation: Perpetrators of tax crimes will lose their good reputation in the eyes of the public and potentially experience a decline in business.

What efforts can be made to prevent tax crime?

- Maintaining integrity and good business ethics within the company.

- Filing tax returns honestly and accurately.

- Using the services of a trusted tax consultant.

- Maintaining good communication with tax authorities.

- Increasing employee awareness about the importance of tax compliance and the dangers of tax crimes.

How do tax authorities prevent tax crime?

1. Issuing tax regulations

Tax authorities are responsible for issuing clear and transparent taxation regulations so that taxpayers can understand and comply with applicable regulations. This will reduce the space for perpetrators of criminal acts to commit tax manipulation or evasion.

2. Monitoring Tax Reporting

Tax authorities also have the duty to supervise and control tax reporting. This is done to ensure that tax reporting carried out by taxpayers does not experience manipulation or deviations that can harm the state.

3. Conducting Routine Tax Audits

In addition to supervision and control of tax reporting, tax authorities also conduct routine tax audits of taxpayers. This audit is conducted to ensure that taxpayers have complied with applicable tax regulations and reported taxes correctly.

4. Imposing Sanctions on Tax Crime Perpetrators

Tax authorities also have the authority to impose sanctions on perpetrators of criminal acts in the field of taxation. These sanctions can be in the form of fines, imprisonment, or other legal actions in accordance with applicable laws and regulations. By providing strict sanctions, it is hoped that it can provide a deterrent effect for perpetrators of criminal acts and prevent similar actions from occurring in the future.

Comments (0)

Write a comment